Setting up effective price rules for customers in bookkeeping is essential for ensuring fair pricing, maintaining profitability, and building strong client relationships. With various types of clients, services, and transactions to manage, having structured and clear price rules is critical for streamlined operations and transparency.

In this blog, we’ll explore what price rules are, why they matter in bookkeeping, how to set them up effectively, and best practices to optimize your pricing strategy.

What Are Price Rules in Bookkeeping?

Price rules refer to the structured guidelines or policies that businesses use to determine the cost of services provided to different customers. In bookkeeping, price rules help ensure consistency and transparency in billing practices, especially when dealing with diverse clients who have unique needs.

These rules can be applied based on various factors, such as:

- Client Type: Small businesses, corporations, or nonprofits.

- Service Type: Payroll management, tax preparation, or financial reporting.

- Volume of Transactions: High or low transaction frequency.

- Customization: Additional services or unique client requests.

By using price rules, bookkeeping firms can maintain uniform pricing structures while accommodating the specific requirements of individual clients.

Why Are Price Rules Important in Bookkeeping?

Price rules are crucial for the following reasons:

1. Transparency

Clients appreciate clarity in pricing. Clearly defined price rules eliminate confusion and build trust between clients and bookkeeping firms.

2. Profitability

By tailoring price rules to account for time, complexity, and resources, businesses can ensure their services remain profitable.

3. Efficiency

Price rules streamline the invoicing process, saving time for both the bookkeeping team and the client.

4. Scalability

As a bookkeeping business grows, standardized price rules make it easier to onboard new clients and expand service offerings without reinventing pricing strategies.

5. Compliance

Accurate pricing ensures compliance with contracts and agreements, reducing the risk of disputes or legal issues.

How to Create Price Rules for Customers in Bookkeeping

Developing effective price rules requires careful consideration of your business model, services, and client base. Here’s a step-by-step guide:

1. Understand Your Costs

Before setting price rules, it’s essential to calculate the costs involved in delivering bookkeeping services. This includes:

- Labor costs

- Software and tools

- Overhead expenses (e.g., office space, utilities)

- Action Tip: Use cost analysis tools to determine your per-hour or per-project expenses.

2. Segment Your Client Base

Not all clients require the same level of service. Segment your clients based on factors such as:

- Business size

- Industry

- Frequency of service required

- Action Tip: Create pricing tiers (e.g., basic, standard, and premium) tailored to different client groups.

3. Define Service Levels

Outline the specific services included at each pricing level. For example:

- Basic: Data entry and reconciliations

- Standard: Monthly financial statements

- Premium: Full-service bookkeeping with advisory services

- Action Tip: Use a service catalog to clarify what each tier includes.

4. Incorporate Variable Pricing

Introduce variable pricing based on:

- Volume of transactions

- Complexity of financial records

- Seasonal demand (e.g., tax season)

- Action Tip: Use automated invoicing systems to adjust for variable pricing factors.

5. Offer Discounts and Incentives

To attract and retain clients, consider offering:

- Volume discounts for high transaction clients

- Loyalty discounts for long-term customers

- Referral discounts for client referrals

- Action Tip: Clearly communicate the terms of discounts and incentives in your price rules.

6. Use Software for Price Rule Management

Leverage accounting and bookkeeping software that supports flexible price rules. Tools like QuickBooks, Xero, or FreshBooks allow you to automate pricing based on predefined rules.

- Action Tip: Train your team to use software features for efficient billing and invoicing.

7. Regularly Review and Update Price Rules

Business environments and client needs change over time. Periodically review your price rules to ensure they remain competitive and profitable.

- Action Tip: Conduct annual pricing audits and gather client feedback to make adjustments.

Common Types of Price Rules in Bookkeeping

1. Flat Rate Pricing

Charge a fixed fee for specific services, regardless of the time or effort required.

- Pros: Simple and predictable for clients.

- Cons: May not account for varying levels of complexity.

2. Hourly Pricing

Charge clients based on the hours worked.

- Pros: Fairly compensates for time spent.

- Cons: Clients may prefer more predictable costs.

3. Value-Based Pricing

Set prices based on the perceived value of your services to the client.

- Pros: High potential profitability.

- Cons: Requires strong client relationships to communicate value.

4. Tiered Pricing

Offer multiple pricing tiers, each with distinct service packages.

- Pros: Flexible and scalable.

- Cons: Requires careful planning to avoid overlap.

5. Performance-Based Pricing

Tie fees to specific performance metrics, such as cost savings or revenue growth.

- Pros: Aligns with client success.

- Cons: Difficult to implement for all clients.

Frequently Asked Questions (FAQs)

1. What are price rules in bookkeeping?

Price rules are structured guidelines that determine how bookkeeping services are priced for different clients based on factors such as service type, client needs, and transaction volume.

2. How do I decide between flat-rate and hourly pricing?

Flat-rate pricing is ideal for predictable, repetitive tasks, while hourly pricing works better for projects with varying complexity.

3. How can I ensure my price rules are competitive?

Conduct market research, analyze competitor pricing, and gather client feedback to ensure your prices align with industry standards.

4. Can I offer customized pricing for large clients?

Yes, customized pricing is common for high-volume or complex clients. Ensure the customization aligns with your cost structure and profitability goals.

5. How often should I review my price rules?

Review your price rules annually or whenever there are significant changes in your business environment or client base.

Final Thoughts

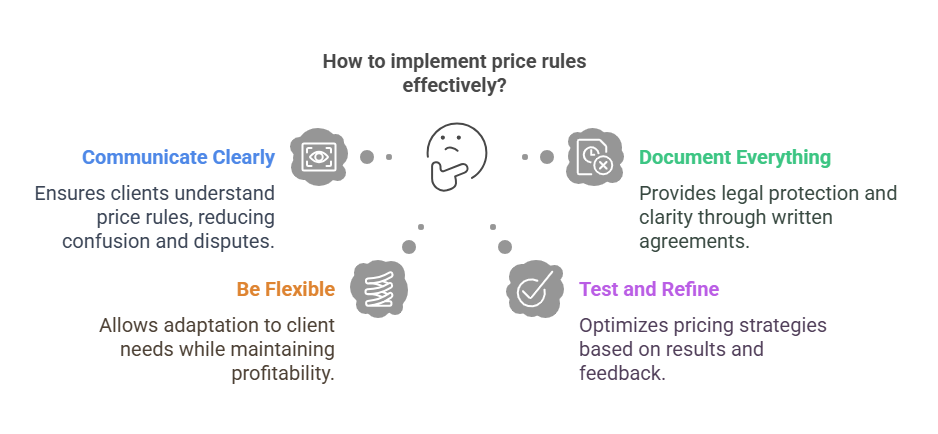

Effective price rules are the cornerstone of successful bookkeeping practices. By implementing structured, transparent, and flexible pricing strategies, you can build trust with your clients, maintain profitability, and scale your business with confidence.

Whether you’re a seasoned bookkeeping professional or just starting out, continuously refining your price rules will help you stay competitive in an evolving market. For tailored bookkeeping solutions, visit Remote Financial Services and discover how we can help optimize your financial management processes.